Housing Supply: What Does it Mean for Your Investment Portfolio?

Now that more millennials are opting to rent instead of buy, rents are steadily increasing, but that means a decrease in the housing supply. Almost 6 million family homes were built between 2012-2019, but it doesn’t offset the 10 million households that were formed during this timeframe. Diana Olick of CNBC reported that “Even with an above-average pace of construction, it would take builders between four and five years to get back to a balanced market.”

In addition to the late-stage home buying for millennials, more baby boomers are opting to stay in their homes longer, keeping their homes off the market.

Two of the major reasons millennials are not buying homes as early as their parents did is because of the high cost of housing and the high level of debt millennials have. This can potentially be a huge economic problem in a few years when boomers are ready to sell their homes, but millennials still can’t afford to buy them.

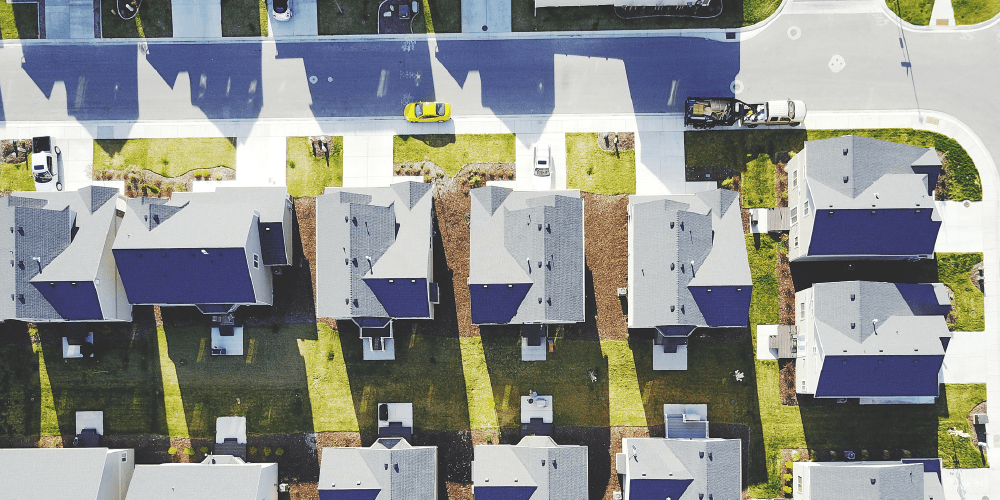

New Home Construction

With rental property housing consistently in need, more real estate investors looking to bolster their investment portfolio may want to consider new home construction Building new homes adds to the housing market supply, and with all the amenities a new home has to offer, like new appliances, modern design, and brand new electrical, plumbing, and heating/air conditioning, allowing you to charge higher rent prices to offset the cost of building the home.

House Flipping

Renovating a home can also be a good return on investment for your rental property investment portfolio. Generally, these homes are also already built, but you’re able to schedule inspections and negotiate the price with the seller. This is a good option for the baby boomers who are looking to sell, but millennials are still unable to afford to buy the house and do the repairs themselves. We’ve created a guide for real estate investors with a breakdown of the cost to renovate a house, if this is the direction you’re interested in going in to bolster your real estate investment portfolio.